rsu tax rate us

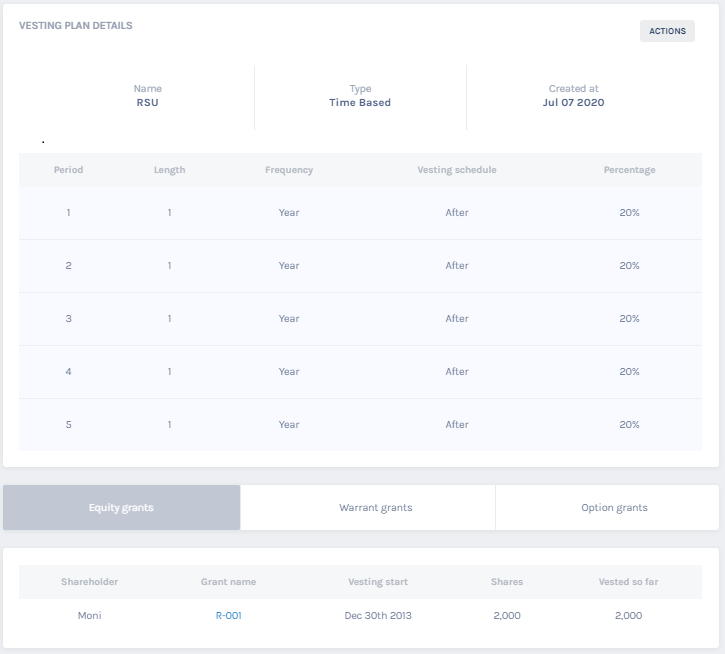

The stock is restricted because it is subject to certain conditions. Restricted Stock Units RSUs Tax Calculator Apr 23 2019 Off Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy.

Rather you receive units that will.

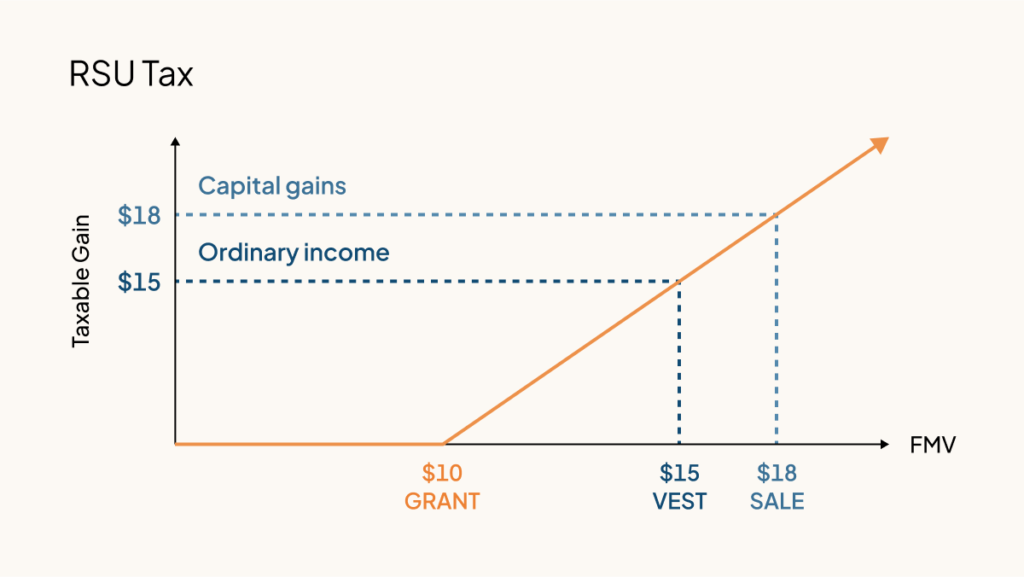

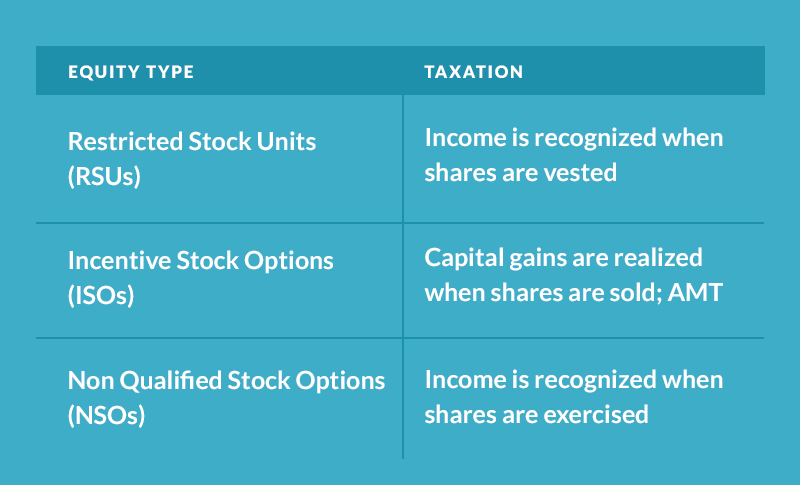

. The Section 83b election can save those with restricted stock quite a bit of money if they play their cards right but it can also be a bit of a gamble. Long-term capital gains tax on gain if held for 1 year past. His experience includes both Canadian and US income tax compliance payroll social tax compensation and tax policy consulting.

Ordinary tax on current share value. It will also tell you the cost basis per share and the amount of taxes withheld. Capital gains taxes come in two forms.

Heres the tax summary for RSUs. Vesting after making over 137700. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained.

A restricted stock unit is a substitute for an actual stock grant. If you live in a state where you need to pay state. LTCG are taxes on stock you sell after owning it for 365.

This rate is 238 20 plus the 38 tax on net investment. His vast experience and understanding of. You calculate your cost basis by multiplying the number of released shares by the cost basis per share.

Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent. Marginal Federal Tax Rate You. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

Vesting after Medicare Surtax max. Since RSUs amount to a form of compensation they become part of your taxable income and because RSU income is. Restricted Stock Unit Rsu Tax Calculator Equity Ftw It is founded in the year 1961 in one of the small villages in Italy.

For your state tax rate itd be a little much for us to pull each states income tax and include it. RSUs are taxed upon the. Restricted stock is a stock typically given to an executive of a company.

If your company gives you an RSU you dont actually receive company stock. Long Term Capital Gains LTCG and Short Term Capital Gains STCG. For one a recipient cannot sell or.

Vesting after Social Security max. Rsu tax rate us Friday September 9 2022 Edit. Taxes are usually withheld on income from RSUs.

Section 83b Election. We are pleased to announce that we have updated our 2020 annual publication of key federal and state rates and limits to reflect updates to the 2020 state unemployment insurance wage bases. So its up to you to select a percentage from the dropdown.

Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry. RSUs are taxed at.

Taxation Of Restricted Stock Units Rsu And Stock Options

What Is A Restricted Stock Unit Rsu And How Is It Taxed

Rsa Vs Rsu What S The Difference Carta

Rsu Taxes Explained 4 Tax Strategies For 2022

Equity Compensation 101 Rsus Restricted Stock Units

Restricted Stock Unit Rsu Tax Strategies To Save On Tax Bill In 2022 Trica Equity Blog

Stock Options Vs Rsus What S The Difference District Capital

.png?width=2108&name=Add%20a%20subheading%20(9).png)

Rsu Tax In Ireland What You Need To Pay File We Have The Expertise

5 Ways To Maximize Restricted Stock Units Rsus

What You Need To Know About Restricted Stock Units Rsus Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Rsus A Tech Employee S Guide To Restricted Stock Units

The Mystockoptions Blog Tax Planning

Stock Options Vs Rsu Restricted Stock Units Top 7 Differences

Why Rsus Are Edging Out Restricted Stock Cfo

Explaining Rsus Or Restricted Stock Units Eqvista

Why Rsus Can Make Tax Season Painful Schmidt

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Rsus A Tech Employee S Guide To Restricted Stock Units

Restricted Stock Units Rsus Tax Calculator Level Up Financial Planning